Refinancing your home is finally within reach.

With RefiNow from Lower, we’re lowering the barriers and making it easier for working families like you to access more savings than ever before.

Save on your home payment and invest in your family.

"I couldn't have asked for a better experience with Lower!"

4.9 ★★★★★ (10,000+)

Apply for RefiNow

Tell us about your household finances and current home loan.

See if You Qualify

We’ll advise you on your options and help you choose what's best.

Refinance and Save

Get breathing room in your budget and create financial peace.

“Lower’s rates are the best around without paying any points.”

Jan - Zillow Review ★★★★★

✔ Verified Home Purchase

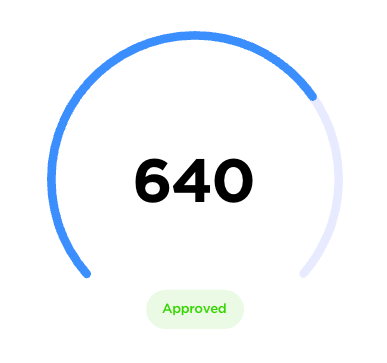

Low Credit Score? No Problem.

With Lower’s RefiNow option, a lower credit score doesn’t have to mean a higher payment. And we won’t do a hard pull on your credit until you know if you qualify.

Want to know if you qualify for RefiNow?

"I couldn't have asked for a better experience with Lower!"

4.9 ★★★★★ (10,000+)

You’ve paid on time.

You've been on-time for the last six months, and only late once in the last year

Your credit score is at least 620.

Not sure what your credit score is? We’ll show you for free when you apply.

You live in your home.

You've been on-time for the last six months, and only late once in the last year

What would you do with an extra few hundred per month?

You're guaranteed to save big when you qualify for RefiNow—the program is only available to those who can cut at least .5% off their interest rate. Imagine what an extra $100 - $250 a month could do for your goals—you could save thousands to pay for groceries, soccer cleats, or pay off debt.

We have the answers you're looking for.

What if I’m not qualified?

Once you apply we'll evaluate your current home loan and household finances. Don't worry, if you're overqualified, we likely have another Refinance product just right for you. If you're under qualified, we may be able to save you money on your home in other ways. Just give us a chance. ☺️

Is my home loan eligible?

The RefiNow product is aimed to help those that have a Fannie Mae Loan that were affected by the Covid-19 pandemic. You can check your loan at: https://www.knowyouroptions.com/loanlookup

Will applying affect my credit score?

When you apply for a Lower RefiNow loan we'll only do a soft credit check to ensure we don't impact your credit score. Once you know your loan options and want to proceed, we'll ask your permission to do a hard credit check.

Will I have to pay for an appraisal?

As a participant in the RefiNow program with Lower, you will receive a $500 credit towards the cost of an appraisal should you require one to determine the current value of your home.

“I looked at several different lenders during my refinance process and Lower had the best rates!”

Jan - Zillow Review ★★★★★ (10,000+)